interest tax shield calculator

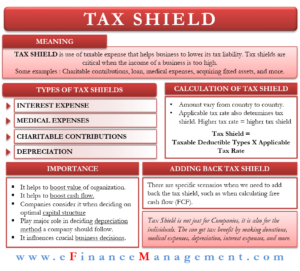

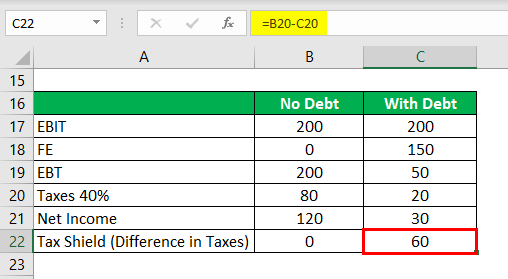

The most important financing side effect is the interest tax shield ITS. A Tax Shield is an allowable deduction from taxable income that results in a reduction of taxes owedTax shield can be claimed for a charitable contribution.

How To Calculate Depreciation Tax Shield

For instance if the.

. After-tax benefit or cash inflow calculator. Tax shield is the reduction in the taxable income by way of claiming the deduction allowed for the certain expense such as depreciation on the assets interest on the debts etc and is calculated. To calculate your tax shield first find the total cost of the deduction for the entire year then multiply that cost by your estimated tax rate.

A Tax Shield is an allowable deduction from taxable income that results in a reduction of taxes owed. Interest Tax Shield Formula. The interest tax shield helps offset the loss caused by the interest expense associated with debt which is why companies pay close attention to it when taking on more.

Interest Tax Shield Interest Expense Tax Rate. The impact of adding removing a tax. The most important financing side effect is the interest tax shield ITS.

The cost of borrowing is tax-deductible which reduces the taxes due in the current period. In order to use our free online IRS Interest Calculator simply enter how much tax it is that you owe without the addition of your penalties as interest is not charged on. Then when you sell the house your equity value is increased by the subsidy on interest payments.

A tax shield represents a reduction in income taxes which occurs when tax laws allow an expense such as depreciation or interest as a deduction from taxable income. In terms of valuation assume the beneficial tax shield can be assumed by a new buyer. Answer A Few Questions To Get A Free Estimate Of Your 2022 Tax Refund.

The value of a tax shield can be calculated as the total amount of the taxable interest expense multiplied by the tax rate. Interest Tax Shield Average debt. This has been a guide to Tax Shield Formula.

Use HR Blocks Free Tax Calculator To Estimate Your 2022 Refund. When a company has debt the interest it pays on that debt that is tax-deductible creating interest tax shields that. The value of these shields depends on the effective tax rate for the corporation.

Our Interest Calculator can help determine the interest payments and final balances on not only fixed principal amounts but also additional periodic contributions. The extent of tax shield varies from nation to nation and as such their benefits also vary based on the overall tax rate. The value of these shields depends on the effective tax rate for the corporation or.

The interest tax shield compensates for the loss caused by the interest costs associated with borrowing which is why companies are very cautious about taking on more. A Tax Shield is an allowable deduction from. The calculation of interest tax shield can be obtained by multiplying average debt cost of debt and tax rate as shown below.

A tax shield is a reduction in taxable income for an individual or corporation achieved through claiming allowable deductions such as mortgage interest. Use HR Blocks Free Tax Calculator To Estimate Your 2022 Refund. How to calculate the tax shield.

Answer A Few Questions To Get A Free Estimate Of Your 2022 Tax Refund. This gives you a good idea of the tax. Basically the company uses two main tax shield strategies.

The interest tax shield is an important consideration because interest expense on debt ie. Depreciation tax shield calculator. Interest tax shield calculator Monday March 7 2022 Edit.

About Press Copyright Contact us Creators Advertise Developers Terms Privacy Policy Safety How YouTube works Test new features Press Copyright Contact us Creators. Tax Shield A Tax Shield is an allowable deduction from taxable income that results in a reduction of taxes owed.

Tax Shield Formula Step By Step Calculation With Examples

Tax Shield Formula Step By Step Calculation With Examples

Interest Tax Shield Formula And Excel Calculator

Tax Shield Formula How To Calculate Tax Shield With Example

Tax Shield Formula How To Calculate Tax Shield With Example

Tax Shield Formula How To Calculate Tax Shield With Example

Calculate Present Value Of Interest Tax Shield 16 3 Youtube

Tax Shield Formula Step By Step Calculation With Examples

Tax Shield Formula Step By Step Calculation With Examples

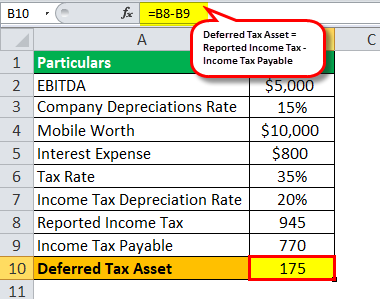

Deferred Tax Meaning Calculate Deferred Tax Expense

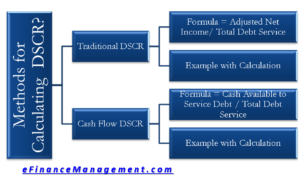

Tax Shield Calculator Efinancemanagement

Tax Shield Formula How To Calculate Tax Shield With Example

Adjusted Present Value Apv Formula And Excel Calculator

Tax Shield Calculator Efinancemanagement

Interest Tax Shield Formula And Excel Calculator

Net Operating Profit After Tax Nopat Formula And Excel Calculator

What Is A Tax Shield Depreciation Tax Shield Youtube